Coronavirus has a huge impact on the lives of people all around the world. The pandemic came with various restrictions on the movement, socializing, and for carrying out everyday activities. And some people have their family living abroad who need financial support. These are the very common effects of COVID-19 pandemic, but do you know about the impact of COVID-19 on the money transfer services.

Importance of money transfer services –

COVID – 19 has made millions of people use online money transfer services to transfer money to their families living abroad. The COVID-19 crises have offered multiple new challenges in the lives of people all around the world. The major problem for money transfer services is providing financial security.

Using online money transfer services allows people for money transfer to Ghana instantly and securely. The apps help you to avoid the need to go out of the house to any agent or bank. These online apps are cheaper than any other money transfer method.

Use of money transfer services:

The increase in the popularity of mobile banking during this pandemic is quite inevitable. However, the traditional methods are outdated now as the present age demands more swift and convenient solutions for money transfer to Ghana. More and more apps have emerged in the modern world due to the rise in the popularity of online methods and have altered the payment methods active the global pandemic has triggered the world.

Benefits of online money transfer:

- It encouraged people to maintain distance from the people.

- It made people carry forward their work while staying at home.

- It helped people to safeguard their family members abroad from any financial problem.

- It offers a convenient way of transferring money.

- The payment protection tool enhances the benefits of online money transfer apps.

- Speed is yet another benefit that the online money transfer apps offer.

- Online money transfer apps reliable and transparent services.

- Online money transfer apps have low fees than traditional money transfer methods.

EziPayApp:

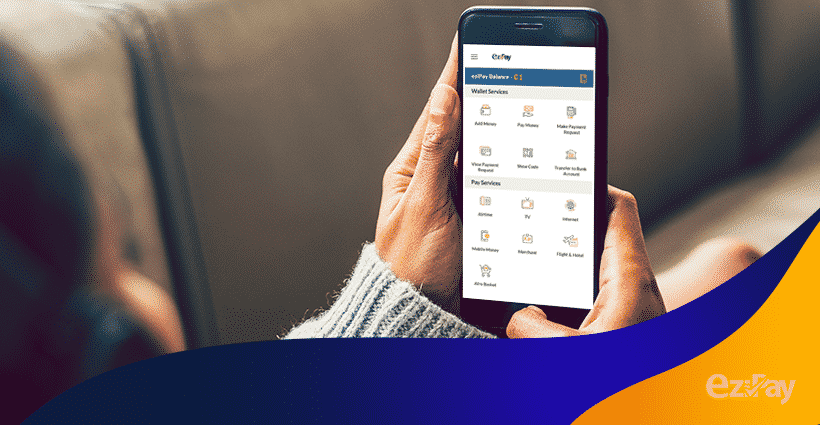

EziPay is one of the best money transfer app that allows you safe, secure, and convenient services. Money transfer with EziPay is quite effective and efficient for the people who are busy in their routine and cannot spare time to stand in queues to transfer money to their families abroad. Bill’s payments with EziPay is another essential thing you can do while sitting at your home’s convenience. EziPay also allows you to book flights, hotels, and movie tickets at an affordable price. EziPay is one such app that has saved people from going out during the pandemic.

Winding Up:

Now you know the effects and benefits of money transfer services during the pandemic condition of COVID-19. Hopefully, this article has provided you with all the necessary details you required to know about the money transfer app.

How do you feel when you have to join the long queues to transfer or receive money? Do you feel it is necessary to go through all the hassles just for transferring some money? However, you don’t have to worry about going through all these hassles with the help of EziPay app services. Now, let’s learn about the EziPay money transaction app.

About EziPay:

EziPay is the cheapest, most convenient way to transfer and receive money from abroad to your loved ones in Ghana at the lowest transfer cost. The benefits of the app don’t stop here; EziPay helps you to transfer money to a bank account from your mobile. And wait, it is not over yet, you can also pay for services and bills to over 250 merchants and businesses in Ghana. EziPay app also provides you an opportunity to book your tickets – movie or travel while sitting at the comfort of your premises.

Save your time and money by online transaction things with EziPay digital platform. It also ensures that you don’t have to face any problem while transferring money and while paying your bills. It is a user-friendly digital platform that helps in efficiently transferring and receiving payment from your friends and family. Now let’s have detailed information about the features offered by EziPay.

Features offered by EziPay:

- Send money to Ghana without hassles.

Are you worried about sending money to Ghana without any hassles? Then, EziPay is there is for your assistance.

Safety and security are another most important feature offered by the app for money transfer in Ghana.

- Airtime & internet top-up

Are you worried about paying your mobile or internet bill during the lockdown period? Then, worry no more as EziPay offers easy and instant recharge services.

Instant money transfer is one of the essential features of EziPay for which it is known in Ghana.

Send or receive money from the merchants with the help of the QR-code facility of the EziPay mobile money app.

Services offered by EziPay app:

- Add money to mobile wallet

Add money to your EziPay mobile wallet direct from your bank account and use this as a payment method over card payments.

You can book international or domestic flight tickets of any destination around the world at an affordable price, not just that you can also book your hotel by using the app.

- Transfer money to local merchants

You can use the EziPay mobile app to pay the local merchants in Ghana without using any other payment option.

Now you don’t have to worry about carrying cash while going out to buy groceries or while ordering things online with the help of the EziPay mobile app.

- Send money to your family abroad

Now you can easily send money to your family members abroad with the user-friendly mobile app – EziPay.

- Recharge or mobile top-up

Easily pay your mobile bill or internet bill while sitting at your home during the lockdown period and even after that to save your time and energy.

Winding up:

Hopefully, now you have understood why EziPay is the best money transfer app in Ghana. Download the app and start paying money online!

Now because of Covid-19, we are all inside our homes, and being at home seems to be quite dull and boring. Imagine you think of watching your favorite shows, but now you need to pay your bill urgently; otherwise, you’ll most certainly miss the show. But don’t worry, you can do it online now just by using Ezipay App. Ezipay makes sure that the payments are made securely and instantly. You can also pay your phone bills, book air tickets, and do a lot more things with this app.

Payment of phone bills

The use of this digital wallet eases your payments online. You can use mobile to shop online, and with the top-notch service that Ezipay provides you, you can also pay with this best online payment app.

Book flight tickets

You can also book local or international flight tickets by Ezipay. All you need to mention is your details, and in just a few steps, you will be good to go.

Pay internet bills

You can also pay your internet bills with this fastest online payment app. Paying your internet bill now is a one-click away.

Shopping bills

Now to avoid using cash during this Covid-19, you should pay your shopping bills online. Ezipay is one of the best online payment app and is designed to make your payments a lot easier.

If you want to pay your bill with the mobile app, Ezipay is the safest option. You can follow these quick and simple steps for the payment on Ezipay, and then you are good to go.

- You can start by creating your account (If you don’t have one). For this, you need to go to ‘Register for free’ option and enter the details like e-mail ID, phone number and unique password. Once you are done with all the required details, then you can click on the ‘create account’ option.

- While you can access it on any device, you can log in with registered e-mail ID and the same unique password you have entered while you were signing up.

- Now you can scroll and choose the of which you want to make the payment. It could be of anything, maybe for a mobile recharge, electricity bill, shopping or tickets.

- Now the last step will be to enter your card details and confirming the payment. Make sure to check the message popping up at the top of your screen for payment confirmation as soon as the payment is processed.

- Make sure that the transaction is successful.

As there has been an increase in the use of mobile to shop online, digital wallets have certainly gained a lot more prominence in many countries around the world. Ezipay, being an online payment app, has brought the trend along with all the features that take away the pain of shelling out cash, be it Ghana, Sierra Leone, or any other city. Growing its popularity all around, Ezipay provides quicker money transactions letting it grow at a large scale.

Are you willing to buy a property abroad? But are you also worried about how you can transfer a large amount of money without any hassles? Are you also looking for an app for easy money transfer from UK to Ghana? If you have all these queries in your mind, then you must dig right into the article below.

There is just one solution for all your payment options; it is none other than EziPay. Let’s learn a little bit more about the payment solutions offered by the digital platform – EziPay.

About EziPay:

EziPay is a safe, secure, and convenient marketplace that offers the best money transfer solutions. It is a digital platform that provides you with the facility to send money to mobile money in Ghana without any hassles. EziPay is a means for transferring money directly from your bank account to the recipient’s bank account without an extravagant transfer and exchange cost. EziPay works with complete transparency and affordable pricing, thus ensuring to provide the best services to the consumers.

Features:

EziPay is a complete package for various kinds of payment solutions. Let’s have a look at the certain features of this excellent digital mobile wallet.

- Low remittance cost

- QR code payment system

- Bank account transfer

- Bill payments

- Hotel and ticket booking

- Top up recharge and internet recharge

- Direct payment to the local businesses

- Payment options for online orders

- Cheapest international way to transfer money

- Safe and secure online money transfer

Benefits of using EziPay as your digital payment app:

EziPay is an excellent digital wallet that serves multiple purposes like mobile money transfer to Ghana and many more. Let’s have a look at the furthermore benefits of EziPay.

- EziPay helps you in sending inward remittance.

- It allows you to pay money to the local businesses.

- It helps you in paying your bills while staying at your home.

- You can use the app for mobile top-up recharge and for paying your internet bill.

- Another great benefit of using the EziPay app is that you can book international and domestic flights at a reasonable price.

- You can also use the EziPay app for hotel booking.

- EziPay offers international money transfer services at low exchange costs.

- The digital mobile wallet can be used to directly transfer the amount in the bank account of the recipient.

- EziPay app is widely used to send money from UK to Ghana.

- QR payment services allow transferring money most safely and securely.

- End- to-End encryption allows nobodies interference in the transaction to avoid any hidden costs.

Winding up:

Now you must know that EziPay allows easy, convenient, and secured money transaction services from multiple countries to Ghana. If you are still unsure about using it, then you must check out the official website of the app today. And yes, EziPay does allow you to transfer money from UK to Ghana.

Ezipay provide services to these following countries :-

EziPay is a private limited company which incorporates the laws of the Republic of Ghana. It is a concept of an online transaction app that uses digital technology to transfer your money in Ghana and Sub-Saharan West African regions. It is launched because of the growing demand of the public to have a convenient and secure payment service.

Ezipay is an improved payment based technology that works with your bank account to offer a safe, simple, and better online payment experience. In addition to the secure sending and receiving payment services, it also provides consultation on customized payment assistance.

Benefits of Ezipay mobile app:

EziPay is the best app for bank money transfer in Ghana which is perfect to use for several ways like –

- Bill payment with Ezipay app

This COVID-19 pandemic lockdown has made it difficult to make your bill payments in person. Thus, you can easily make your mobile bill payment, internet bill payment, and electricity bill payment with its mobile app by sitting in the comfort of your home.

- Flight booking with EziPay app

However, it is not a safe time to travel anywhere due to coronavirus infection. But you can use the EziPay mobile app to make your flight bookings or train bookings in the future.

- Sending money to your loved ones

Due to the complete shutdown across the world, it is difficult for people to make money. There is no source of income, but it is required to bear the expenses. Thus, you can use the app for bank money transfer in Ghana.

What wallet services does the EziPay online transaction app deliver?

The online app offers you to add money to its wallet directly from your bank accounts.

The EziPay provides you to quickly transfer money in the Ezipay wallets of your loved ones, family, and friends.

- Transfer money directly to the bank accounts

It also offers you to transfer payment directly from your bank accounts to the receiver’s bank account at a very nominal cost.

Why choose Ezipay as your money transfer app?

EziPay’s motive to provide a user-friendly atmosphere to its clients with complete transparency.

Ezipay is an easy to use money transfer mobile app, which efficiently transfers your money in Ghana.

The application is a convenient way of transferring money to your loved ones at a very affordable price.

It offers instant service, but if the payment might get stuck due to network issues, then it gets refunded in your account within 14 working days.

It is a password-protected application which makes it a secured money transferring app. Also, there is no intermediate, so there is no chance of any fraud.

Conclusion:

After having learned about the EziPay app, you can choose it as your money transferring mobile app without any doubts or queries. Don’t wait for more and download the app to transfer money to your friends or family in Ghana.

International money transfer Ghana

If you want to send money to friends, family, or colleagues in Ghana, you don’t have to deal with an expensive and complicated process. Sending money has never been easy; whether you want to help your someone in business or just sending money to your family, you can now use an online money transfer to Ghana. If you compare bank rates and transfer fees and exchange rates, you can also get to know the best deals available.

Comparison is essential, but how to compare?

Many websites will help you compare and get the cheapest way to send money to Ghana. You can use their interactive comparison tables that lets you compare exchange rates, transfer fees, and other details for sending funds to businesses or your loved ones in Ghana.

Best ways to send money to Ghana

You have multiple options to send money. The best ways to send money to Ghana are given below.

- Bank transfers: Major banks may allow you to wire money to banks in Ghana, but they will charge you a hefty amount.

- Providers with cash pickup: Companies like MoneyGram and Western Union offer several cash pickup centersin Ghana

- Money transfer specialists: Companies like EziPay and many others let you transfer money to bank accounts in Ghana.

- Money transfer apps: Apps like EziPay are a safe, secure way to send, receive, and store money through your mobile phone or an app. Top up your account and then send money to loved ones, who can easily withdraw their funds. It is the best way for international money transfer to Ghana.

Guide to send money to Ghana

- Download the App from the Apple App Store or Google Play store. This App is available on both platforms.

- You can first register for an account with a provider, supplying your name, address, contact details, proof of ID, and information about your selected payment method.

- You can then provide your recipient’s name, contact information, and bank account details as required.

- Enter the amount you wish to transfer and complete the transaction.

- Keep track of any receipt you receive to let you monitor the progress of your fund transfer.

EziPay App provides you the following facilities in Ghana—

Enjoy the freedom of going cashless in Ghana with the EziPay App. This digital money wallet helps you to resolve your day to day money transfer needs. The following are the services provided by this money transfer app in Ghana.

- Get the inward remittance in your bank

- Transfer your inward remittance to Mobile Money

- You can “Add Money” in your digital wallet

- Pay money by using EziPay

- You can also generate a payment request

- Now just scan and pay the bills

- Transfer the money to Bank Account

- You can buy airtime with service providers like- MTN, Vodafone, Glo, Airtel, Tigo

- Pay your Tv Subscription bills for the providers like Kwese, DSTV, and GOTV

- Pay your internet bills for service providers like Busy, Surfline, MTN, Vodafone, Glo. MTN Fibre

- Use Mobile Money for Airtel Money, MTN Mobile Money, Vodafone Cash

- Now earn extra reward points by booking your flight & hotel Bookings with EziPay App.

In conclusion

EziPay customers can register for these money transfer services and use it to transfer funds, pay bills, to book and to purchase, and much more. EziPay allows instant money transfer into bank accounts and mobile wallets. This App is one of the safest ways to transfer funds online internationally. During this time, when the world is suffering from COVID-19, this App makes you sit back and relax and lets you enjoy all the services hassle-free.

Are you willing to send money to your family or friends in Ghana online? You must know that choosing the best money transfer app will be one of the biggest confusions, especially if you haven’t done this before. It is important to choose an application that offers reliable, safe, and authentic money transfer without any flaws and hassles.

But while searching for the best company to send money online, you might find yourself in a dilemma. So, you must always do proper research on how, why, and which company proves to be the best option for you.

Key tips to keep in mind while choosing the best money transfer app:

It is quite an overwhelming and confusing task to choose an online money transfer app for Ghana. Choose the company only if it is offering you the following features:

- Multiple transfer options

The company must offer you various transfer options for your feasibility. Several companies allow you to take advantage of the changing market, and you can process your money transfer when the exchange rates are in your benefit.

You must opt for the company that offers you to transfer money at a very low remittance cost. The remittance cost must be according to the amount you want to transfer, and there must not be any hidden costs.

There are chances that a company itself might cost you a lot in terms of their processing fee for offering better exchange rates. So, just go for the company, which provides excellent exchange rates without paying the extravagant amount.

Best online company to transfer money to Ghana

EziPay app services offer the easiest, quickest, and most convenient method for transferring money to Ghana at an economical cost. You can take advantage of different online payment options with EziPay like mobile payment, internet bill payment, electricity bill payment, and many more.

How to send money online?

Now that you have an idea of which company to choose for transferring money to Ghana, here are quick steps that you need to follow in order to do so, using EziPay:

- Enter the amount you want to transfer

- Add the recipient’s name, phone number, and account details.

- Now you can pay the amount by using an online wallet, credit, or debit card.

- Just click on ‘pay,’ and your money will be transferred to Ghana in no time.

These were things to keep in mind with EziPay transactions.

Are you looking for an option to transfer money to a bank account in Ghana? EziPay is your spot-on money deliverance to a bank account of any of your relatives, vendor, or any other billing party.

EziPay is a money transacting application right on your mobile phone that gives you the ease to transfer money to a bank account. This widespread pandemic Coronavirus has got people to be on a house arrest. It has brought the economy of almost the entire world to a full stop. With its basic symptoms of fever, cough, and other respiratory issues, Coronavirus has got us home driven. All we do in our daily lives is now driven through the internet and mobile devices.

Major drawbacks of being locked in:

- People cannot visit their relatives and local vicinities in order to resume their normal lives.

- The normal eight-hour office shifts have now shifted to the home offices.

- Older people and children who were left to their respective cares have now become care package for the otherwise working class of the society.

- While some people are facing terminations from the jobs, some are willingly resigning in order to be able to take care of the children, and elderly people in the house.

- There is a major loss of income in households, leaving people with no other choice but cutting their costs.

In light of these general problems faced by people who are locked in their houses due to the growing spread of the Coronavirus, EziPay gives you the ease to transfer money. Take advantage of the various NGOs collecting donations for the cause by contributing your bit so you can help someone in need. Also, donate and help relatives in need of some money to suffice their daily hunger.

You can also receive salaries and other compensations that you are eligible through various government policies. EziPay is keen to help people get through this challenging time that has a drastic effect on the economy and the lives of the local folks.

Take away:

Whether you want to pay money to the grocery vendor, or you want to send money to family in need, or even donate to various NGOs, you can easily EziPay money transfer to bank account in question. This way, you will not only help people, and continue a normal life, but you will also minimize the dangers of spreading the virus. EziPay helps you eliminate the transfer of hard cash and further minimize the spread of the novel Coronavirus.

Very few studies support remittances in sub‐Saharan Africa. The researches that are available portray a very different picture of these developing countries than the ground reality.

A national survey of 5,998 households was conducted to determine the reasons for the overseas remittances in Ghana. The study exposes the inward remittance myths in Ghana and further estimates that remittances could be three times large, bringing Ghana on par with big remittance-receiving countries such as Mexico and the Philippines. The study utilizes a smaller range to initiate projects using a matched sample of senders and recipients of remittances to assess the quantity and impact of overseas remittances by using household‐level surveys.

Foreign remittances are larger in value, which, according to the studies, have significant remittances impacts on Ghana population, as locally delivered remittances reach below par parts of the population. But, the remittances are unevenly distributed for the poorest regions as they receive more in the center regions than in northern Ghana. The study asserts a need to examine the overseas effects of remittances as these can be large and stem from rural populations.

Inward remittance myths and facts unveiled:

The convention, presented by Geraldine Adiku, ‘All the money I raised, I raised from Ghana’ states the understanding of reverse remittance practice among Ghanaian population and expats in the United Kingdom. Remittances are often conceived as money sent by overseas migrants from ‘developed’ into ‘developing’ countries, the research of Geraldine investigates the face of transnational economic exchanges between expats and their relatives – reverse remittances. All myths about international money transfers have been unbiased by this study.

Where we thought that once people migrate and start to earn, they send back money to their families back in Ghana, studies reveal reverse remittances. This means families also tend to support the people out there in the western world facing recessions and the effects of the widespread novel Coronavirus.

In the context of Ghanaian migrants in the UK, the study reveals that transnational financial transactions between migrants and their relatives are driven by their different access to several types of capital, and their motives for migration. These factors affect whether a migrant will send remittances or receive reverse remittances instead.

This article is published by EziPay, one of the coolest money transfer App. We hope you liked reading through.

Remittances are the funds that are sent by an immigrant to his native country. It is the prime source of foreign cash inflow for most of the developing countries. According to “The World Investment Report” for 2019, global Remittance stood at around $500 billion in 2018. Africa alone had a remittance inflow of around $70 billion with Ghana, Nigeria, and Egypt taking up the largest share.

Remittances are of two types:

In general terms, outward Remittance is the basic process of sending money from your native country to somebody abroad. A Ghanaian family is sending money to someone in the U.K for his foreign study or other expenses, for example.

In basic terms, inward Remittance simply implies sending money from another country to your native country. Someone settled in the U.K sending money back home in Ghana to his family, for example.

Different types of inward Remittance:

These are the remittances that are sent through your relatives. The income of the informal remittance currency is not recorded in the statistics of the National account.

These are the remittances that are transferred through official channels. And the income of formal remittances is recorded in the statistic of foreign exchange of the nation. Financial institutions, like banks and transfer companies, perform formal transfer services.

Inward remittance charges:

Most of the banks don’t charge any handling fee for inward Remittance. However, inward remittance charges that are applied to the transfers are all in the hands of the correspondent bank or other financial institution. Also, you have an option to instruct your bank to provide full payment to the beneficiary. The inward remittance charges in Ghana are not constant. They are different from bank to bank or from one transfer company to another.

Process for inward Remittance:

The inward Remittance is conducted by a processor and an approver. The task of the processor is to process the Remittance after checking the authenticity of all the documents. While the task of the approver is to approve the transfer. However, each financial institution works with its own set of rules and regulations. Also, different institutions might give you different types of instruction for inward Remittance.

Winding Up:

We hope this article was useful to you in knowing about inward and outward Remittance. This article was sponsored by EziPay, one of the most trusted money transfer app.