When someone wants to send money overseas, the biggest worry of the people is the security and safety of their money. Everyone wants to have a secure medium for money transfer so that the amount reaches straight to your home region(Togo, Senegal, Benin, Niger, Sierrra Leone, Mali, Cote D’lvoire, Guinea, Burkina Faso, Ghana) without any loss.

Apart from safety, people also look for other facilities like ease and convenience while doing international money transfers. The lives of the people are already quite busy; thus, it gets difficult to manage time to visit service providers physically and wait in queues for hours to complete the transaction. People are always looking for easy ways to transfer money efficiently, safely, and quickly.

List of best mobile money transfer apps :-

Mobile money transfer apps are the latest technology added to the list of online money transfer methods. Its secure money transfer services are accessible for all using advanced mobile phones. All you need is a mobile phone and an active internet connection to complete the money transaction.

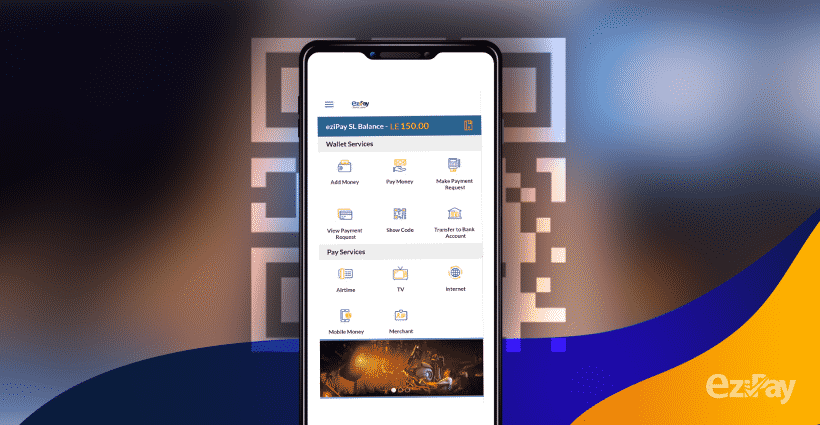

EziPay Money Transfer app:-Ezipay is a highly praised money transfer service provider in the industry for quite a while now. It also offers online bank transfer services via E-wallet or credit or debit cards.

Western Union Money Transfer app :- Western Union is use to send money online or in person to friends, family around the world and african countries like Togo, Senegal, Benin, Niger, Sierrra Leone, Mali, Cote D’lvoire, Guinea, Burkina Faso, Ghana from rest of the world.

MoneyGram Money Transfer app :- The MoneyGram money transfer app is an easier way to send money from the United States to rest of the world.

worldremit Money Transfer app :- WorldRemit is a fast and secure service that lets you transfer money online using a computer, smartphone, or our app. Bank transfer, online money transfer, money transfer from credit card.

Ria Money Transfer app :- My Ria is the new app from Ria Money Transfer that will make you save time on your money transfers with the usual security and trust in an easier way.

Zelle Money Transfer app:- Zelle is a fast, safe and easy way to send and receive money with friends, family and others you trust.Zelle is a fast and secure service provider.

How does the mobile money transfer app work?

The process of money transfer via EziPay, Western Union, MoneyGram, Worldremit, Ria, Zelle is quite simple. Download the app and install it on your mobile phone. Once you have downloaded the app – open the app to sign up. Please fill up all your information and set a password to your account to protect it from theft. After the process is completed – you will have to verify your email address. Then, log in to the account you have created.

The next step is to choose a destination where you want to transfer money. You can first check the countries in which the services of the app are available. Then, enter the recipient’s details and the amount of money you want to transfer to your loved ones.

The receipt of the transaction will get generated with the details of the exchange rate and transfer fee. Go through the details such as terms and conditions of the app before the completion of the transaction. Press the “Send Money” button. Once you click the button, the transaction of the money gets initiated; your money will get delivered to the recipient instantly. You will get to know how easily you can send money via trusted remittance partners like EziPay, Western Union, MoneyGram, World Remit, Ria, Zelle.

Why must you opt for mobile money transfer apps?

Mobile money transfer apps such as EziPay, Western Union, MoneyGram, world remit, Ria, Zelle are simple and easy.

EziPay is a trusted remittance partner

It is a convenient app – you can send money whenever you want to.

It is the most accessible mobile money transfer app.

Only a few clicks are required to pay money to your loved ones abroad.

Send money from anywhere to African countries such as Togo, Senegal, Benin, Niger, Sierrra Leone, Mali, Cote D’lvoire, Guinea, Burkina Faso, Ghana without any hassles.

Coronavirus has a huge impact on the lives of people all around the world. Several restrictions are laid on the movements, the ability to carry out regular activities, and socializing, which is creating hustle-bustle in the lives of the people. There are many people whose families live in Africa (Togo, Senegal, Benin, Niger, Sierra Leone, Mali, Cote D’lvoire, Guinea, Ghana, Burkina Faso), and people need to support their families financially. Let’s look at the blog to understand the importance of online money transfer services during the covid-19 and how you can send money securely during this pandemic.

What is the importance of mobile money transfer apps during the covid-19 outbreak?

There are millions of people all around the Africa specially in Togo, Senegal, Benin, Niger, Sierra Leone, Mali, Cote D’lvoire, Guinea, Ghana countries who use online money transfer services to support their families living from USA , UK, Canada, Australia, China. Apart from the effect of COVID-19 on money transactions, people and businesses have faced various new challenges. The large industries are also hugely impacted by the pandemic’s attack.

A quick and safe way for money transfer with low-cost remittance to your loved ones is the greatest priority of the people worldwide. There is a vast range of online money transfer services that mobile remittance apps provide to the migrated community of the world for helping their families abroad during the coronavirus attack.

Online money transfer solutions allow people to transfer money instantly, easily, and securely while sitting in the proximity of their homes. Now, you no more have to step out of your homes to banks or to remittance agents to send money to your family in Africa(Togo, Senegal, Benin, Niger, Sierra Leone, Mali, Cote D’lvoire, Guinea, Ghana, Burkina Faso). Mobile money is one of the safe ways to send money abroad during this virus outbreak. These online services are cheap and easy ways to help your family in their difficult times.

Where can you send money using a mobile money transfer app?

With the restrictions laid on the movement of the people, online mobile money transfer apps like EziPay, is the best remittance solution people are using for sending or receiving money without leaving their homes. You can choose from one of the various ways available on the money transferring apps to send money to your loved one. The most feasible way is to use a mobile wallet, credit, or debit card for completing the transaction process. EziPay lets you pay money from around 149 countries in the world to Africa(Togo, Senegal, Benin, Niger, Sierra Leone, Mali, Cote D’lvoire, Guinea, Ghana, Burkina Faso) at the lowest possible cost.

The prime benefits of using mobile money transfer apps –

The increase in the popularity of mobile remittance apps has been quite evident from the time it has emerged. But there are still some people who haven’t yet got their hands wet in this new technological advancement. If you are one of them, then this is the right time for you. You don’t have to make your family suffer during these global crises. If you are confused about why you must choose it over traditional methods, you must look at its benefits.

Following are the benefits of mobile money apps:

- They are easy and convenient to use.

- They provide secure and reliable transaction services.

- You can transfer money in an instant while sitting at your home.

- These apps are highly cost-efficient.

Now you can make such transactions anytime, anywhere, using online money transfer services with EziPay.

Online banking services being the easiest and hassle-free way of transferring foreign currency from one country to another, have built a scope for new and more advanced service providers to evolve. EziPay is one such online currency transfer provider that allows you to send money to Sierra Leone from anywhere across the world. Check out the EziPay’s website to learn about the best way possible and to know how to transfer funds online. Please note that not every provider is the same, so you must study a little before you choose your service provider.

Sending money is one of the most common things that millions of people do in the world each day. From international companies to families who are willing to buy a house in another country and finally to the people who send money to Africa(Sierra Leone) to their family; it is like a regular task for them.

But this task can be very frightening and may cost you a lot if you don’t perform it with smartness. Most of the people are still unaware of the fact that these international money transferring companies have hidden costs. With banks, money transfer companies, and foreign exchange brokers, there are only two major costs involved. First is the service charge for transferring your funds, and the other is to convert your money from one currency to another.

Most of the profit of the money transfer companies are extracted from their money conversion ways. These service providers don’t work at the actual interbank exchange rates, but with their own exchanging rates. The profit made by these service providers is commonly known as the ‘Spread.’ Although it is a common practice, you must always be careful about it, as not every company is so upfront about it.

Here is the list of the smartest way to send money to Africa(Sierra Leone):

- First and foremost way to transfer money are banks

Banks are the largest financial institutions that are quite effective for transferring a large number of funds. Most business organizations, including small, medium, or large businesses and even individuals use banking services to transfer money to Africa(Sierra Leone). Banks are the most common ways to transfer money; however, now they are being scrutinized because of their high hidden fees. Ask the customer advisors before choosing the bank as your platform for transferring money because otherwise, you may end up losing a lot of money in their hidden charges.

- Ask foreign exchange brokers

The broker’s main task is to act as a middle man between the bank and the customer. They usually have great relations with most of the banks, and they work to provide the most competitive rates for trading one currency to another. Again, they may charge you a ton of money for transferring the money from one country to another. The advantage of foreign exchange services are:

- They help you buy properties in a foreign country.

- They allow small businesses to make international payments.

- Online money transfer providers

The internet has made our lives easy in every possible way. Transfers through the internet is a very easy method for money transfer for both the national and international(Africa) levels. It is the most cost-efficient and smartest way to send money to Africa(Sierra Leone) for business or individual purposes.

Online transferring channels are regulated by the authorities and agencies, so they are the safest way of sending and receiving money. Some of these service operators take two to three days for completion of the transaction, but providers like EziPay offer instant online money transfer service. Online services have proven to be a revolution in the banking sector at both national and international levels.

If you are worried about your money transfer during COVID-19 then worry not, EziPay has made it a lot easier than you imagined. You can now transfer mobile money in a few clicks. You can enjoy the ease of paying and receiving mobile money online in seconds. So, there is no need to worry about your money transfer, and you can talk to your loved ones as much as you want, and the best part is that you don’t have to leave your location to look for an money transfer retailer. EziPay’s convenient, speedy and uncomplicated recharge service is all you need. You can now stay connected to your friends and family 24/7, and it is all because of EziPay.

How to To Send Money online with EziPay

- Sign up or log in using your login credentials.

- As soon as you log in, you will see an option of ‘Money Transfer’ in the ‘pay services’ section.

- Select the option, and then you will see a page asking you for the mobile network.

- Next, you have to enter the mobile number and the amount you wish to top-up.

- Complete the payment with the payment details by using debit/credit card, bank account, eWallet, or mobile money on EziPay’s trusted and secure payment platform. You are now done, and you will receive your mobile money instantly.

- You’ll receive an SMS confirmation once the payment is made.

Save efforts

You no longer need to scratch cards or run around carrying cash looking up for a store to send money online. It doesn’t matter what your location is, be it home, in transit, or even abroad, you can transfer mobile money online with EziPay anytime and anywhere with the stress-free service. The app lets you make the fastest and easiest way to transfer mobile money in a matter of minutes.

EziPay’s coverage and services

Be it any mobile network, EziPay offers fast and stress-free online recharge services. You can send mobile money without making efforts, and it is a lot easier than you think it could be. transfer mobile money service is available round the clock, any time of the day.

EziPay can be accessed on anything, be it a smartphone, computer, or tablet. As all phones require a recharge, Mobile money is added almost instantly as soon as the payment is made.

Simple, Safe and Instant

It would be great for you to send mobile money to your family or friends living abroad in an instant. EziPay not only lets you do a quick transaction, but it also offers competitive exchange rates and zero fees on money transfers. With EziPay, you won’t feel left behind by your family and you can virtually catch up with them any time.

EziPay is the best mobile money transfer app. So, what are you waiting for? send mobile money online with EziPay.

Coronavirus has a huge impact on the lives of people all around the world. Several restrictions are laid on the movements, the ability to carry out regular activities, and socializing, which is creating hustle-bustle in the lives of the people. There are many people whose families live abroad, and people need to support their families financially. Let’s look at the blog to understand the importance of online money transfer services and how you can send money securely during the COVID-19 pandemic.

What is the importance of mobile money transfer apps at present?

There are millions of people all around the world who use mobile money transfer services to support their families living abroad. Apart from the effect of COVID-19 on money transactions, people and businesses have faced various new challenges. The large industries are also hugely impacted by the pandemic’s attack.

A quick and safe way to send money with low-cost remittance to your loved ones is the greatest priority of the people worldwide. There is a vast range of online money transfer services that mobile remittance apps provide to the migrated community of the world for helping their families abroad during the coronavirus attack.

Online money transfer solutions allow people to transfer money instantly, easily, and securely while sitting in the proximity of their homes. Now, you no more have to step out of your homes to banks or to remittance agents to send money to your family abroad. Mobile money is one of the safe ways to send money abroad during this virus outbreak. These online services are cheap and easy ways to help your family in their difficult times.

Where can you send money using a mobile money app?

With the restrictions laid on the movement of the people, online mobile money transfer apps like EziPay, is the best remittance solution people are using for sending or receiving money without leaving their homes. You can choose from one of the various ways available on the money transferring apps to send money to your loved one. The most feasible way is to use a mobile wallet, credit, or debit card for completing the transaction process. EziPay lets you pay money from around 149 countries in the world to Sierra Leone at the lowest possible cost.

The prime benefits of using mobile money transfer apps –

The increase in the popularity of mobile remittance apps has been quite evident from the time it has emerged. But there are still some people who haven’t yet got their hands wet in this new technological advancement. If you are one of them, then this is the right time for you. You don’t have to make your family suffer during these global crises. If you are confused about why you must choose it over traditional methods, you must look at its benefits.

Following are the benefits of mobile money apps:

- They are easy and convenient to use.

- They provide secure and reliable transaction services.

- You can transfer money in an instant while sitting at your home.

- These apps are highly cost-efficient.

Now you can make such transactions anytime, anywhere, using online money transfer services.

In the technology-driven world we live in today, mobile money transfer to Sierra Leone from US UK by cash, check, bank draft, or money order may seem like it’s going the way of the dinosaur and specially when need mobile money transfer across the borders such as online/mobile money transfer to Sierra Leone from US, UK, China.

But now ezipay introduces inexpensive & fastest ways of transfer mobile money to west africa ( Ghana, Niger, Burkina Faso, Mali, Benin, Guinea Bissau, Senegal, Togo, Ivoire d’Coast ) from UK, USA and China.

Advantages of online money transfer from Sierra to UK, USA and China through ezipay.

Speed: The speed of the online money transfer from Sierra Leone to UK USA transaction through ezipay makes it much easier to manage your finances and pay your bills on time. This in turn can help you avoid late fees and other charges.

Security: There is always the possibility that the check will be lost or stolen while passing from your mailbox to the recipient. If the check is lost in the mail, you could face late fees as you try to convince your creditors that you actually made your payment on time.

Flexibility: EziPay makes it easy to transfer online money from sierra to uk usa when needed to make purchases or bill payments, enjoy the high security and flexibility to make payments.

Winding Up: transfer online/mobile money to Sierra Leone from US, UK, China or anywhere around the world through ezipay is fastest, easier and secure method.

With the development in technology and modernization, the world has become more like a global village. More and more people in the world migrate to other countries for education, jobs, or a better lifestyle. Similarly, many people of mobile money transfer to Sierra Leone from UK have migrated to other parts of the world. It has become very common for the people living abroad to send money to Sierra Leone with the mobile app.

The traditional international mobile money transfer to Sierra Leone is a complicated procedure that requires spending a lot of your money and time. The internet has managed to find a way that allows the people to send money to Sierra Leone with low-cost remittance without any hassles.

How to choose the right platform for mobile money transfer to Sierra Leona?

You can use the social media platform to learn about the feedbacks of the various apps that allow you to do mobile money transfer to Sierra Leona from the UK. Take out time for research before choosing the right platform for you. Once you get a platform shortlisted, you must first try to Send money to Sierra Leone from the UK instant with the mobile app a low amount of money to anyone to minimize the risk of loss in future big transactions. Once you are sure about the platform’s authenticity and credibility, you must trust it for transferring big amounts to your loved ones or business.

What documents are required for the transaction?

Send money to Sierra Leone from the UK instant with the mobile app are quite different than the banks or any other traditional money transfer methods.

You can do easy and Send money to Sierra Leone from the UK instant with the mobile app without too many documents. However, you will only require basic details of both the sender and the receiver, such as the bank account details, name, contact details, and the address to initiate the transaction process.

The transaction charges and the transfer fee

The transferring platform charges every time you are trying to send money to Sierra Leona with a mobile app or any other overseas location. The total mobile money transfer to Sierra Leone fees vary from app to app, which makes it quite challenging to choose the right app to solve your purpose. Try to opt for the app that offers you the lowest processing cost; however, you must confirm its authenticity and credibility. Once you are satisfied with the results, only then you should use the particular app to carry forwarding your transaction.

Wrapping Up

Using Send money to Sierra Leone from the UK instant with the mobile app method to transfer mobile money to Sierra Leone makes the task easier, simpler, and faster for both the receiver and the sender. Apps like EziPay enable the Diaspora population of the world to help their family or loved ones instantly financially. It not only helps you save your time but also saves a lot of your money which you might spend on the traditional methods. Thus, start using online mobile money apps to transfer money from your account to another’s in an instant.