Coronavirus has a huge impact on the lives of people all around the world. Several restrictions are laid on the movements, the ability to carry out regular activities, and socializing, which is creating hustle-bustle in the lives of the people. There are many people whose families live abroad, and people need to support their families financially. Let’s look at the blog to understand the importance of online money transfer services and how you can send money securely during the COVID-19 pandemic.

What is the importance of mobile money transfer apps at present?

There are millions of people all around the world who use mobile money transfer services to support their families living abroad. Apart from the effect of COVID-19 on money transactions, people and businesses have faced various new challenges. The large industries are also hugely impacted by the pandemic’s attack.

A quick and safe way to send money with low-cost remittance to your loved ones is the greatest priority of the people worldwide. There is a vast range of online money transfer services that mobile remittance apps provide to the migrated community of the world for helping their families abroad during the coronavirus attack.

Online money transfer solutions allow people to transfer money instantly, easily, and securely while sitting in the proximity of their homes. Now, you no more have to step out of your homes to banks or to remittance agents to send money to your family abroad. Mobile money is one of the safe ways to send money abroad during this virus outbreak. These online services are cheap and easy ways to help your family in their difficult times.

Where can you send money using a mobile money app?

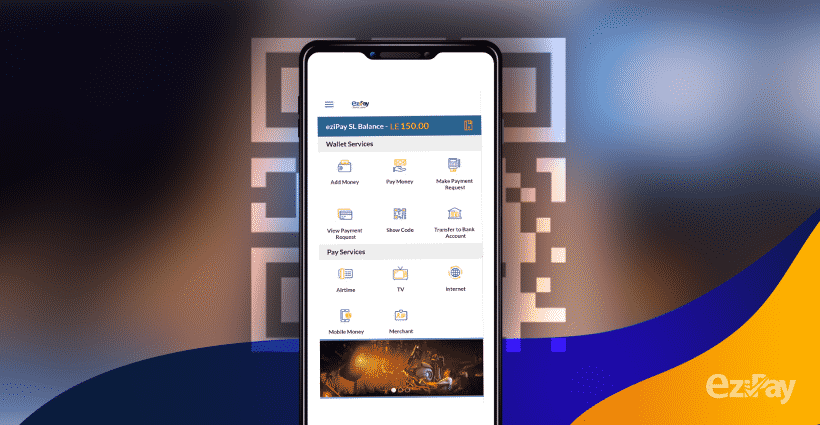

With the restrictions laid on the movement of the people, online mobile money transfer apps like EziPay, is the best remittance solution people are using for sending or receiving money without leaving their homes. You can choose from one of the various ways available on the money transferring apps to send money to your loved one. The most feasible way is to use a mobile wallet, credit, or debit card for completing the transaction process. EziPay lets you pay money from around 149 countries in the world to Sierra Leone at the lowest possible cost.

The prime benefits of using mobile money transfer apps –

The increase in the popularity of mobile remittance apps has been quite evident from the time it has emerged. But there are still some people who haven’t yet got their hands wet in this new technological advancement. If you are one of them, then this is the right time for you. You don’t have to make your family suffer during these global crises. If you are confused about why you must choose it over traditional methods, you must look at its benefits.

Following are the benefits of mobile money apps:

- They are easy and convenient to use.

- They provide secure and reliable transaction services.

- You can transfer money in an instant while sitting at your home.

- These apps are highly cost-efficient.

Now you can make such transactions anytime, anywhere, using online money transfer services.

No one wants to deal with expensive and complicated ways of sending money to their family, friends, or anybody else. Whether you want to send mobile money to Sierra Leone to help your family or to pay your business debts, it is something that you must fuss about. You can easily send money to Sierra Leone online without worrying about paying hefty transfer charges with online payment methods. But while choosing between the bank and online transaction services, you must first compare the transfer and exchange fees of the service providers to send money to Sierra Leone.

Here is the list of the best way to transfer money internationally:

- Online Money Transfer Companies

The foremost thing to do before transferring money online is to compare the rates of service providers. You must know about the transfer and exchange rates of the providers you are willing to choose to send money to Sierra Leone. It is best to choose the one that offers fast and economical service to transfer money to Sierra Leone online and save you time and money.

If you are unsure to know which service provider to choose, then you must follow the tips mentioned below:

- Transfer Fees

It is very important to find out whether the provider is charging a fixed amount or some percent of your transfer amount. Some of them may also offer free transfer services, in case of a big transfer amounts.

- Exchange rates

Mostly, the service provider charges exchange rates for their profit. Thus, it would help if you first compared the rate of the currency exchange rate to make a wise decision to transfer money to Sierra Leone.

- Ways to send and receive money

Online transferring services (like EziPay) offer you to pay directly using Mobile money, through your credit card, debit card, or internet banking. You need to make sure that the provider you choose sends the money instantly, and the recipient can receive the amount directly in their Sierra Leone Mobile Money wallet, or bank account.

- Speed of transferring money

If you can spend a little more time on research, you can find better service providers. EziPay is an example of one such service provider that allows you to make a quick money transfer to Sierra Leone. If you are looking for the best money sending app, then you must choose EziPay.

- The limit of transferring money

The amount of your transaction forms the basis of the selection when it comes to choosing the service provider. For a large amount, you must look for the company that offers the least transferring rates.

It is an online money transfer system with no extra transfer charge. It is like a bank transfer, but in this case, the sender does not have to know the receiver’s bank information to send money to Sierra Leone.

The process

- The sender just has to log in to his bank’s website and fill up a form with the email information of the receiver.

- A security question gets generated, which the sender has to share only with the receiver.

- The receiver’s bank is notified, and then the receiver has to share the security question to complete the transaction.

- This transaction may take up to 3-5 days to complete.

All the details and notifications are shared by email and are completely safe and secure.

Both electronic money transfer and traditional money payment ways are available to transfer money to Sierra Leone from uk usa. The only thing is that you must research and make sure that you choose the best way to transfer money internationally.

Ezipay provide services to these following countries :-