Coronavirus has a huge impact on the lives of people all around the world. Several restrictions are laid on the movements, the ability to carry out regular activities, and socializing, which is creating hustle-bustle in the lives of the people. There are many people whose families live abroad, and people need to support their families financially. Let’s look at the blog to understand the importance of online money transfer services and how you can send money securely during the COVID-19 pandemic.

What is the importance of mobile money transfer apps at present?

There are millions of people all around the world who use mobile money transfer services to support their families living abroad. Apart from the effect of COVID-19 on money transactions, people and businesses have faced various new challenges. The large industries are also hugely impacted by the pandemic’s attack.

A quick and safe way to send money with low-cost remittance to your loved ones is the greatest priority of the people worldwide. There is a vast range of online money transfer services that mobile remittance apps provide to the migrated community of the world for helping their families abroad during the coronavirus attack.

Online money transfer solutions allow people to transfer money instantly, easily, and securely while sitting in the proximity of their homes. Now, you no more have to step out of your homes to banks or to remittance agents to send money to your family abroad. Mobile money is one of the safe ways to send money abroad during this virus outbreak. These online services are cheap and easy ways to help your family in their difficult times.

Where can you send money using a mobile money app?

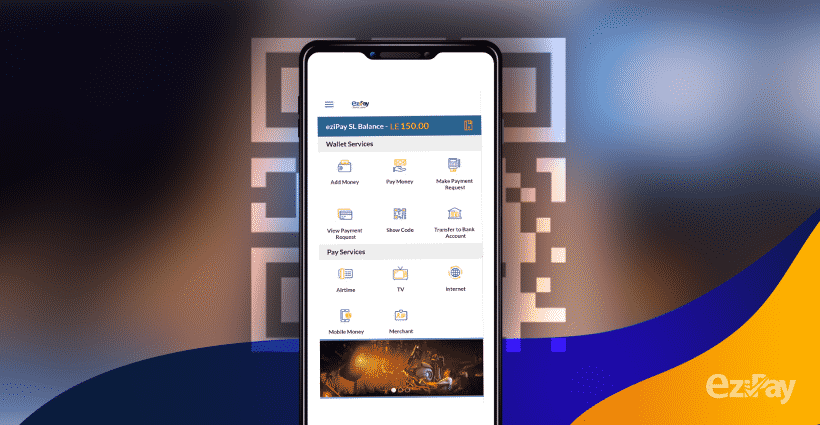

With the restrictions laid on the movement of the people, online mobile money transfer apps like EziPay, is the best remittance solution people are using for sending or receiving money without leaving their homes. You can choose from one of the various ways available on the money transferring apps to send money to your loved one. The most feasible way is to use a mobile wallet, credit, or debit card for completing the transaction process. EziPay lets you pay money from around 149 countries in the world to Sierra Leone at the lowest possible cost.

The prime benefits of using mobile money transfer apps –

The increase in the popularity of mobile remittance apps has been quite evident from the time it has emerged. But there are still some people who haven’t yet got their hands wet in this new technological advancement. If you are one of them, then this is the right time for you. You don’t have to make your family suffer during these global crises. If you are confused about why you must choose it over traditional methods, you must look at its benefits.

Following are the benefits of mobile money apps:

- They are easy and convenient to use.

- They provide secure and reliable transaction services.

- You can transfer money in an instant while sitting at your home.

- These apps are highly cost-efficient.

Now you can make such transactions anytime, anywhere, using online money transfer services.

Want to send money home? Find the fastest and secured money transfer service for you.

When people thought that sending money home was a bit tough job to do, it became a lot easier with the rise of digital innovations and transformations happening. It is all thanks to FinTech solutions for emerging up with hassle-free and cost-saving services. During the wake of COVID-19, while you are living abroad and being the breadwinner of the family, it is sure you would want to send money to them instantly, and this is when apps like EziPay help you.

Global remittance plays a more prominent role in the lives of a large proportion of the diaspora community across the world. People send money to families living in different parts of the world. It was earlier a bit hectic task, but it is now made a lot easier. Instant payment capabilities, smart payment solutions for retail and online banking have made the lives of consumers easy as they can purchase goods and make payments online via mobile quickly and conveniently.

Hassle-free money transfer service that you can trust

You must choose the right money transfer service for your needs as it is essential, especially if you have to send money abroad regularly. EziPay can gain your trust by being one of the best online transaction apps. You can test this yourself by comparing it with other apps that provide you with the same services. These important trust factors will help you determine the right App for transactions:

- You can track your transactions, and it has a clear communication service.

- It is secure and uses the best possible threat protection and cybersecurity technology

- Money is delivered without any delays

- Money transfer provider is fully-verified and regulated EMI institution

- No hidden charges as detailed transfer fees are outlined before the transactions

- It is flexible with transfer and payout option to suit up your requirements

- Competitive exchange rates and reasonable transfer fees allow the transfer to be much easier and economic

If the money transfer solution that you choose checks all the above lists, then there is no reason for you to hold back. You must choose this financial institution to transfer money. The trusted app is reliable when it comes to online remittance. You can send money with the low-cost remittance, which is a quick solution for superfast and instant money transfers.

EziPay – A money transfer app for sending money to family abroad

While everyone’s preferences and needs are different, various factors influence the type of money transfer services you choose and the type of work you do, the hours, and the type of lifestyle you lead. Speed and convenience are big priorities that push you to transfer money using a mobile app. This secure money transfer service makes sure to give you the best speed and hassle-free services.

With the development in technology and modernization, the world has become more like a global village. More and more people in the world migrate to other countries for education, jobs, or a better lifestyle. Similarly, many people of mobile money transfer to Sierra Leone from UK have migrated to other parts of the world. It has become very common for the people living abroad to send money to Sierra Leone with the mobile app.

The traditional international mobile money transfer to Sierra Leone is a complicated procedure that requires spending a lot of your money and time. The internet has managed to find a way that allows the people to send money to Sierra Leone with low-cost remittance without any hassles.

How to choose the right platform for mobile money transfer to Sierra Leona?

You can use the social media platform to learn about the feedbacks of the various apps that allow you to do mobile money transfer to Sierra Leona from the UK. Take out time for research before choosing the right platform for you. Once you get a platform shortlisted, you must first try to Send money to Sierra Leone from the UK instant with the mobile app a low amount of money to anyone to minimize the risk of loss in future big transactions. Once you are sure about the platform’s authenticity and credibility, you must trust it for transferring big amounts to your loved ones or business.

What documents are required for the transaction?

Send money to Sierra Leone from the UK instant with the mobile app are quite different than the banks or any other traditional money transfer methods.

You can do easy and Send money to Sierra Leone from the UK instant with the mobile app without too many documents. However, you will only require basic details of both the sender and the receiver, such as the bank account details, name, contact details, and the address to initiate the transaction process.

The transaction charges and the transfer fee

The transferring platform charges every time you are trying to send money to Sierra Leona with a mobile app or any other overseas location. The total mobile money transfer to Sierra Leone fees vary from app to app, which makes it quite challenging to choose the right app to solve your purpose. Try to opt for the app that offers you the lowest processing cost; however, you must confirm its authenticity and credibility. Once you are satisfied with the results, only then you should use the particular app to carry forwarding your transaction.

Wrapping Up

Using Send money to Sierra Leone from the UK instant with the mobile app method to transfer mobile money to Sierra Leone makes the task easier, simpler, and faster for both the receiver and the sender. Apps like EziPay enable the Diaspora population of the world to help their family or loved ones instantly financially. It not only helps you save your time but also saves a lot of your money which you might spend on the traditional methods. Thus, start using online mobile money apps to transfer money from your account to another’s in an instant.